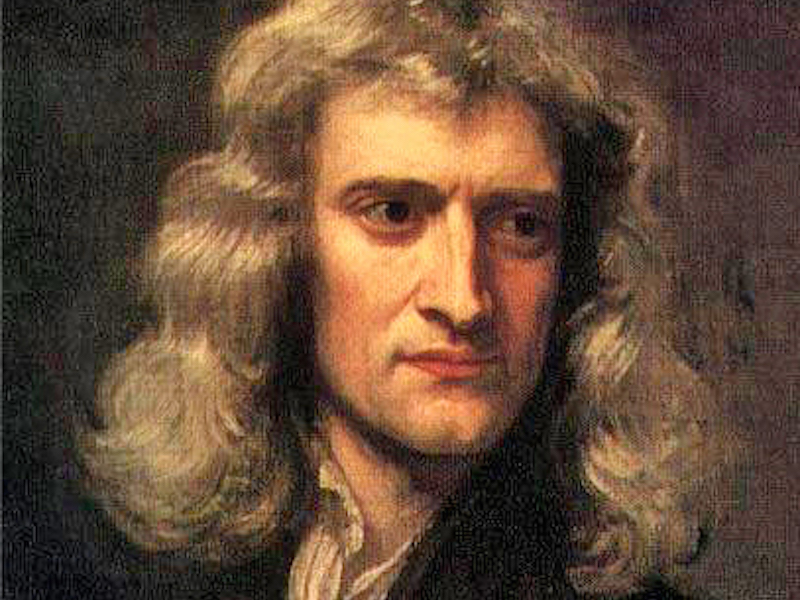

Isaac Newton was one of the smartest people to ever live.

But being a smart physicist is not necessarily the same thing as being a smart investor.

And, unfortunately for him, Newton learned that the hard way.

In an updated and annotated text of Benjamin Graham’s classic “The Intelligent Investor,” WSJ’s Jason Zweig included an anecdote about Newton’s adventures investing the South Sea Company:

“Back in the spring of 1720, Sir Isaac Newton owned shares in the South Sea Company, the hottest stock in England. Sensing that the market was getting out of hand, the great physicist muttered that he ‘could calculate the motions of the heavenly bodies, but not the madness of the people.’ Newton dumped his South Sea shares, pocketing a 100% profit totaling £7,000. But just months later, swept up in the wild enthusiasm of the market, Newton jumped back in at a much higher price – and lost £20,000 (or more than $3 million in [2002-2003’s] money. For the rest of his life, he forbade anyone to speak the words ‘South Sea’ in his presence.”

Here’s a look at how South Seas moved back then.

Newton obviously wasn't an unintelligent person. He invented calculus and conceptualized his three laws of motion. But this little episode shows that he wasn't a smart investor because he let his emotions get the best of him, and got swayed by the irrationality of the crowd.

Or as Graham described it: "For indeed, the investor's chief problem - and even his worst enemy - is likely to be himself."